Young people in New York have a great knowledge of many subjects, but they have much to learn about personal finance.

Many states have already incorporated financial education into the school curriculum, with some starting lessons as early as kindergarten. Twenty states, including Utah, Rhode Island, Tennessee, Ohio, and West Virginia, require students take a personal finance class to graduate high school. New York should get with the program.

I issued an Executive Order on Financial Literacy in 2019 directing my office to identify ways to enhance New York State residents’ personal finance knowledge and understanding on issues such as mortgages, student loans, credit card debt and more.

But we should also be focusing on financial literacy for the next generation to ensure young people have the skills to effectively manage their finances and avoid falling into the trap of spiraling debt.

According to a National Endowment for Financial Education 2022 report, 80% of those surveyed stated they wished they’d been required to take a personal finance class in school. Also, a study by the Financial Industry Regulatory Authority, a not-for-profit corporation regulated by the Securities and Exchange Commission, found respondents with higher financial literacy were more likely to make financial ends meet than people with lower financial know-how.

In New York state, during last year’s legislative session, eight bills were introduced to include financial education in schools starting as early as Pre-K. One bill called for the creation of a financial literacy fund, which would provide funding for grants or programs to establish financial literacy programs, specifically targeting at-risk populations. These bills merit further discussion.

In September 2022, the New York State Education Department (SED) convened a Blue Ribbon Commission charged with examining the state’s high school graduation measures. Recommendations from the commission to the Board of Regents, related to ensuring educational excellence and equity for New York’s diverse student body, are expected to be released soon.

Several Board of Regents members have voiced support for adding personal finance as a requirement to obtain a high school diploma. I’m encouraged that the issue of personal finance was included in this important discussion and hope that it will be given serious consideration. Adding financial education to New York’s curriculum can be successfully implemented, as evidenced by some of our schools already offering a personal finance class.

For example, Mott Hall V, a South Bronx high school, is offering personal finance taught in conjunction with a required economics course. Students learn theory but also follow the stock market in real-time, research corporate earnings and select stocks. They appreciate the real-world lessons that can be applied in the future.

The importance of learning personal finance can’t be underestimated, and I’m committed to helping New Yorkers strengthen their financial knowledge and understanding. The stresses associated with financial difficulties can adversely affect one’s physical or mental health and hurt family members as well. Education in financial literacy can be an important step toward accessing a better job, improving one’s quality of life, and providing peace of mind. Let’s put financial acumen into our kids’ educations.

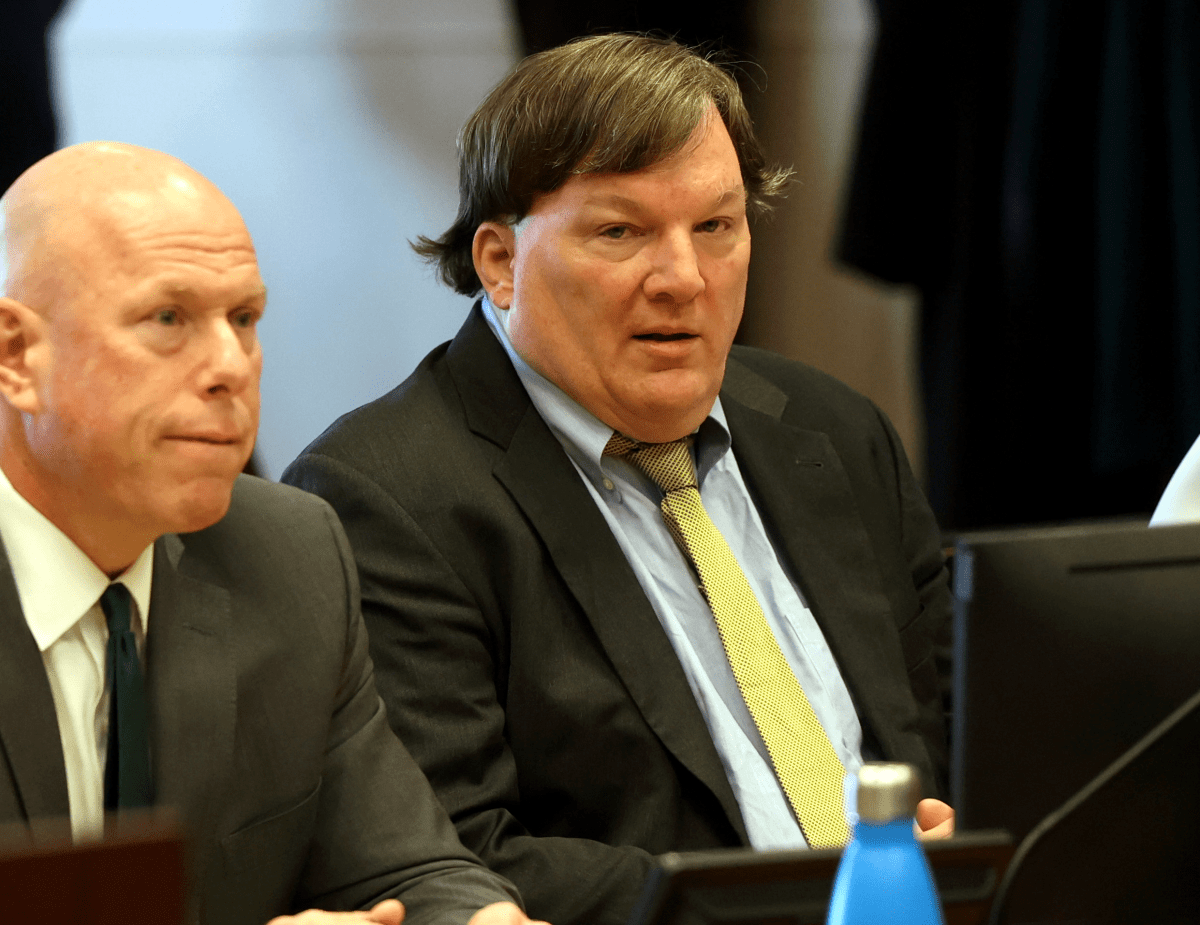

Thomas DiNapoli, as New York state comptroller, serves as the primary state official overseeing public finances across New York state.