Life insurers need to look well beyond COVID-19 deaths to see how the global pandemic is altering the mortality risk of people they cover, a medical insurance expert said on Wednesday.

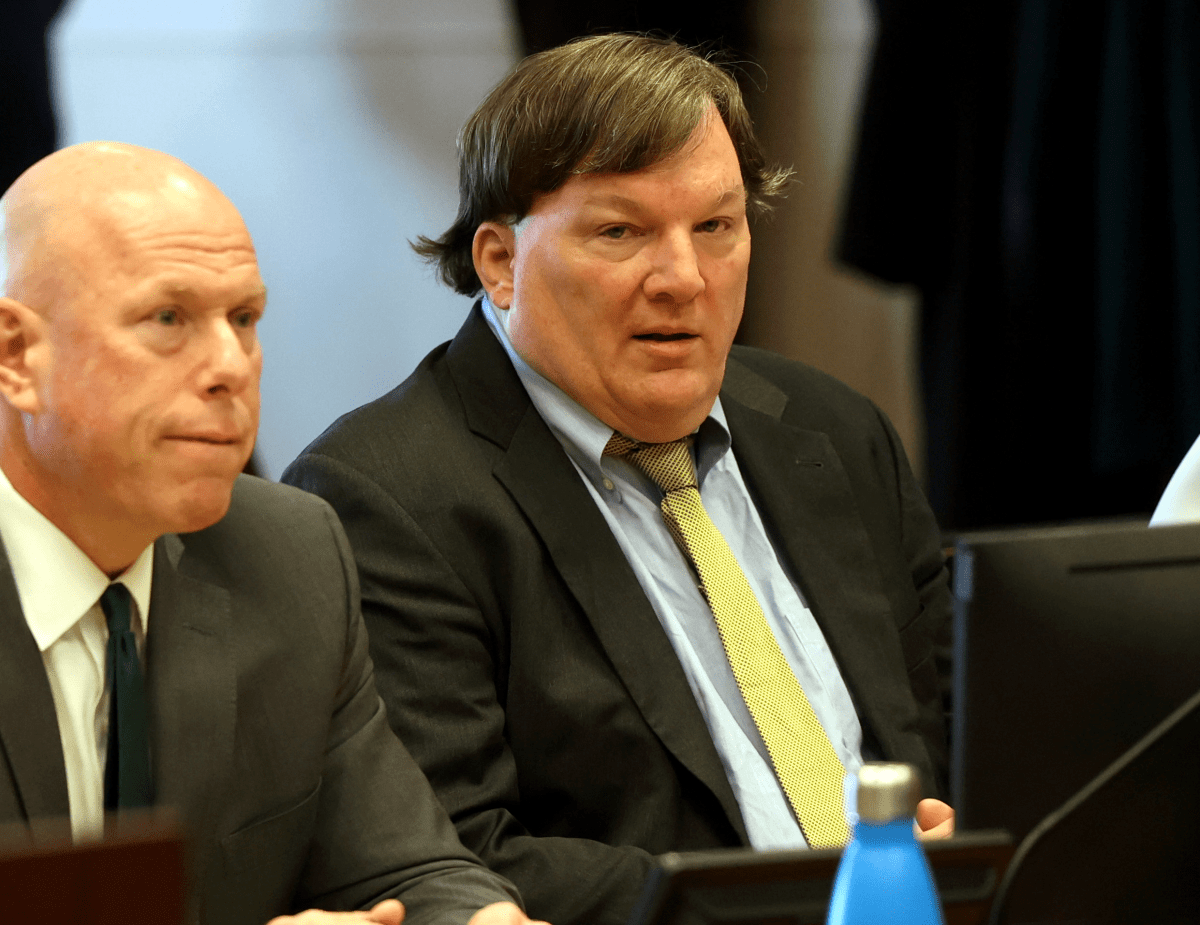

Data show that one in eight Americans who survived being hospitalized for COVID were dead within five months of their recovery – but not from COVID, Paulo Bandeira Pinho, vice president and medical director of innovation at Diameter Health, said at the Reuters Future of Insurance U.S.A. 2021 conference.

That is because the highly contagious virus leaves people more susceptible to many other ailments, elevating the risk of death from those other, seemingly unrelated causes, he said.

“The acute virus isn’t the big concern in and of itself. It’s really just the tip of the iceberg,” Pinho said. “There’s really a whole lot of unknowns that are coming out of infections with COVID that I think the industry needs to be cognizant of.”

To see the video, click https://vimeo.com/566793878/6a9fcce8fb

The new information is altering assumptions about death rates, he said, so in writing policies, insurers will need to find more detailed medical histories of individuals – possibly even using wearable health monitors – to help determine risk.

At the same time the long-term health effects are still evolving and modeling is difficult, he said.

Vaccinations also pose a thorny issue for insurers: excluding non-vaccinated people from coverage could harm insurers’ reputations. At the same time, new variants of the disease and potential vaccine side effects complicate how to write coverage for those who are vaccinated.

“I don’t see the insurance industry necessarily being prejudicial to somebody that’s been vaccinated by charging higher premiums,” he said.

But insurers will need to determine those who are at risk from not having been vaccinated, and those at risk of side effects from receiving vaccines, he said.

“I think the insurance industry is going to be much more discerning at the time of underwriting,” he said.