Rent prices are out of control in New York City following the tumultuous economic consequences of the COVID-19 pandemic.

As median rent prices rose 33% between January of 2021 and January of this year, more and more New Yorkers are struggling with the reality that they may not be able to call the city home for much longer.

When prices for apartments fell dramatically during the COVID-19 pandemic, many tenants thought they had found the opportunity of a lifetime. Two years later, these same apartments are now subject to skyrocketing rents, making it impossible for current tenants to continue to afford their homes.

“We are seeing a lot of rent increases,” said Jennifer Hernandez, lead housing organizer with Make the Road New York, to amNew York Metro July 6. “During the pandemic people left the city, and [now] some people are moving back or who are moving into New York and so I think some landlords see it as an opportunity to get more from their units or from their buildings and raising rents really high.”

At the same time, landlords of small apartment buildings (3 families or fewer) lost rent income during the pandemic, and find themselves at risk of financial ruin too, according to Mayor Eric Adams.

“Small landlords are at risk of bankruptcy because of years of no increases at all, putting building owners of modest means at risk while threatening the quality of life for tenants who deserve to live in well-maintained, modern buildings,” the Mayor said following the Rent Guidelines Board meeting June 21.

In 2021, a small-landlord advocacy group, Small Properties Owners of New York (SPONY), pushed the Rent Guidelines Board to approve a hike in rent on stabilized properties.

“The hardship is not exclusive to one side,” SPONY member Jan Lee said of the campaign at the time, “The hardship is reflected on us as well.”

However, following an analysis by technology group JustFix.nyc, data indicates that there aren’t as many “mom and pop” small-time property owners and landlords as Adams indicates.

In a study released by the group, more than 60 percent of rent-stabilized homes are owned by landlords with portfolios of more than 1,000 units overall.

“The data unequivocally shows that large landlords own the vast majority of rent-stabilized housing in New York City,” the group said in a statement in June.

Hernandez agreed and said through her work with Make the Road NY, she has seen extraordinarily high rent increases, which she considers to be in some cases a form of eviction.

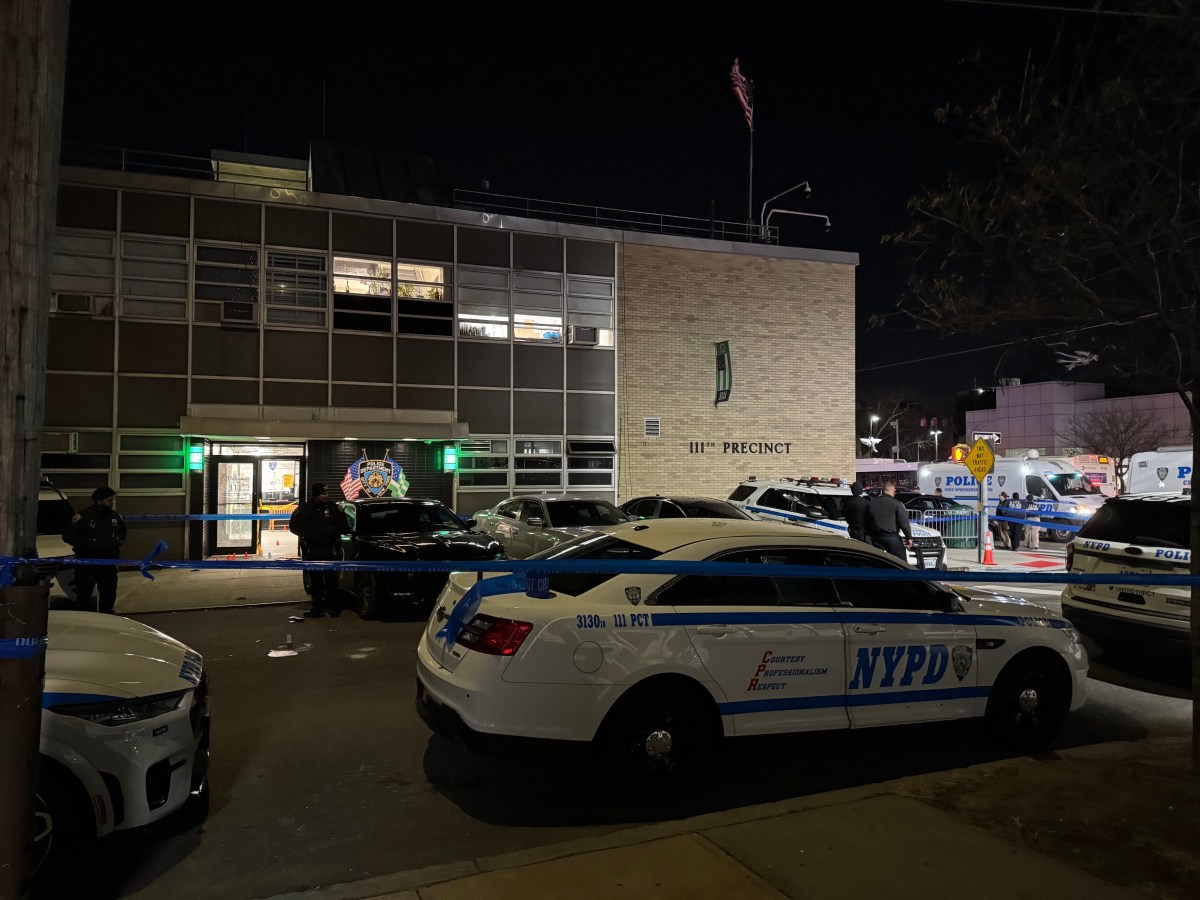

“Some of the highest rent increases we’ve seen with our membership a member in Brooklyn who’s getting a $1,200 increase,” said Hernandez. “We have a member in Queens who is getting a $900 increase. These are outrageous rent increases and obviously a big part of that issue is the lack of regulation. “[For people who don’t live in rent stabilized apartments] there is no protection against any rent hike. For a lot of folks a rent increase that is big enough is the same as an eviction, even though you don’t go through an eviction process.”

For New Yorkers who do not live in rent-stabilized apartments or dwellings, there is no limit to how high landlords can raise the rent, and no current legal recourse to engage in to demand a lower rent rate.

Hernandez said the only way that Make the Road NY can help tenants attempt to pay a more reasonable rate is to help tenants advocate in discussions with landlords or property owners.

“There’s very little protections that tenants have and so we [Make the Road NY] are often not able to support people much, apart from trying to negotiate prices [with landlords],” said Hernandez.

Another contributing factor to the uncertainty to the availability of housing was the end of the 421-a tax abatement program. The program provided a tax incentive to developers who set aside projects for affordable housing.

While Mayor Adams tweeted that he believed the expiration of the tax abatement without a proper replacement program would be detrimental to the city’s housing production, NYC Comptroller Brad Lander disagreed, saying the tax incentive was a false solution to the affordable housing crisis.

“Rearranging the number and letters is tantamount to slapping a gold-plated bandaid on to hold together a deeply inequitable and opaque property tax system, and then pretending we’ve fixed our affordable housing crisis. Tinkering around the edges may be what developers want, but it’s not what New York City needs,” Lander said in a statement March 17.“It’s time to let 421-a sunset – and take our best shot to build a fair and stable property tax system that eliminates disparities, facilitates rental development, and focuses our scarce affordable housing resources on genuinely affordable housing.”

Make the Road leader Hernandez agreed with Lander’s sentiments about the controversial 421-a program.

“There’s been this narrative that ‘yeah, there’s a production of units’, a lot of those units are actually not even affordable to the people that need them,” said Hernandez. “The people with the lowest income actually don’t even have access to these units. When there’s a studio going for $2,000, that is not affordable and a lot of folks have families. They are not actually targeting the folks that are the most at risk to become homeless.”

Tenants who live in buildings that aren’t stabilized could face emergent consequences if legislation to protect tenants like the Good Cause Eviction, and could face displacement and potentially homelessness.

One tenant from Jamaica, Queens said she has been having nightmares about not being able to afford a place to live if her landlord increases her rent.

“I have two kids, it’s just us and I work full time to pay for everything,” she said to amNewYork Metro. “We have lived in this apartment for three years now and last year the rent got so high it is most of my check. If it goes up any higher, we are going to move in with my sister.”

This is the first in a multi-part series called “Rising Back Up,” focusing on evaluating and finding solutions to some of the problems facing New York City in the wake of the COVID-19 pandemic. Our next part will center around ways to address rising real estate costs.