The legislature and Gov. Kathy Hochul made a deal on housing as part of the budget. The package would likely mean housing costs for New Yorkers will go up, not down.

Ideologues on the left and tenant organizations–which don’t actually represent tenants–want to extend rent regulation, misleadingly called “good-cause eviction,” statewide. The deal will extend it to all New York City apartments. This policy is really just rent control under a different name. It also makes housing providers “guilty until proven innocent” when they need to evict bad tenants, causing them to pass on their losses to honest tenants who pay their rent.

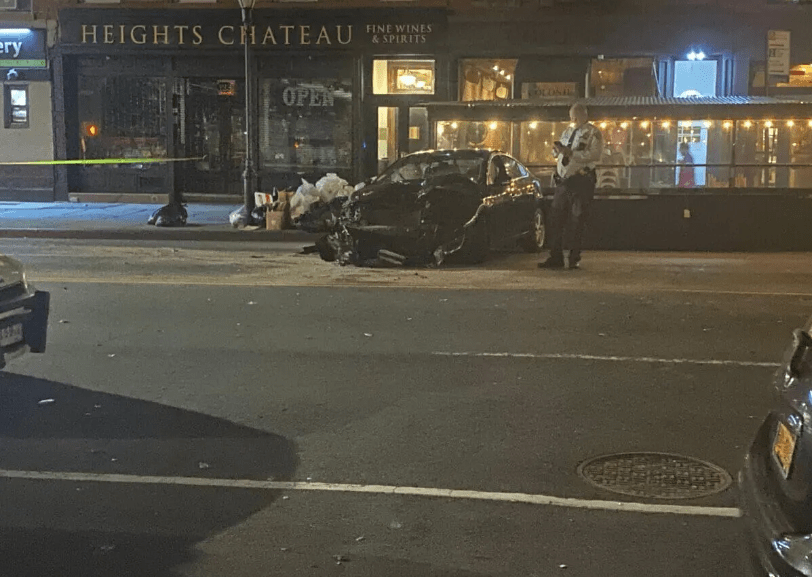

The squatter problem has shown how broken the housing court system is. We’ve seen recently how homeowners can be arrested for changing locks on a squatter without getting a judgment from housing court first, which can take months and thousands of dollars. Homeowners and housing providers all deserve the right to control their own property, without first having to prove “cause” in a lengthy judicial process.

Whenever you force prices down in a competitive market–and rental housing in New York’s cities is a competitive market, with thousands of competing suppliers–you cause a shortage and you misallocate the scarce good, which in this case is housing.

Activists often say, “Follow the science!” and, in this case, they should take their own advice. The gold-standard study of the effects of New York City rent regulation programs on tenants showed that they actually increased rents for most tenants, including those in rent-stabilized units, because they discouraged rental construction and conversions and because renters did not want to leave rent-stabilized units even when it would have made more sense for them to live elsewhere.

A recent study of San Francisco rent control in the top economics journal, the American Economic Review, found that rent control reduced renter mobility by 20% and rental housing supply by 15%, likely causing rents to rise in the long term.

The deal also brings back a slightly revised version of the 421-a tax credit for building “affordable housing” in the City.

The 421-a program used a softer form of rent control, forcing housing providers to keep rents artificially low for some tenants while passing on the costs to the majority of tenants and to taxpayers. A 2022 study published by the prestigious Review of Economics and Statistics revealed that the added fiscal cost of building one unit under 421-a was $1.6 million. There are far less costly ways to get housing to the truly needy.

The governor should work with a bipartisan group of legislators to raise the floor area ratio in Manhattan, without conditions, and legalize basement apartments. That would at least be a clean win for housing affordability. It’s not likely to happen but it will be a good test for whether the governor actually cares about solving the housing affordability problem, or simply wants to appear to care.

Jason Sorens, PhD, is an economist with the American Institute for Economic Research. He has taught at Yale, Dartmouth, Saint Anselm College, and the University at Buffalo.