Having a job to afford a house and a car is the American Dream. But the American ideal of entrepreneurship is very different for a cannabis business owner. Due to federal laws, the thousands of people who work in the legalized cannabis industry aren’t afforded the same opportunities– they struggle to get a car loan, acquire a mortgage, or even a credit card.

In 2021, New York legalized cannabis while pushing for equity in historically underserved communities. Many entrepreneurs and aspiring small business owners were thrilled to hear that cannabis was finally legalized in the state: we responded to the news by working up plans to invest our blood, sweat, and life savings to create small businesses selling legalized cannabis. However, the disconnect between Federal and State-level laws stunts the industry in its infancy. While it’s legal to operate a cannabis dispensary, it seems that across the nation, our businesses aren’t treated as such. We are cut off from the traditional U.S. financial system and left on our own to come up with much-needed capital funding to grow and get our businesses off the ground. As a minority planning to apply for a cannabis processing license in New York State—I am now hesitant whether this is a path I want to go down.

The banks and other financial services institutions are reluctant to transact with us because of the fragmentation between state and federal laws. The current law powers the federal banking regulators to penalize banks for providing financial services to a cannabis-related business. Meaning we are left to find funding on our own. Small businesses already have difficulty procuring start-up funds and resources; the added cost of high fees from the few state-chartered banks that accept cannabis business accounts only adds to the financial burden. Cannabis operations backed by large corporations afford to pay these bank fees. Small businesses will cease to exist if the status quo continues, and big corporations will monopolize the legal cannabis market.

Legalized cannabis was intended to right the wrongs of past cannabis-related inequities. But we are getting left behind once again. Businesses are getting their wings cut before they can flourish. With limited access to the banking system, they are limited in accepting different forms of payments. Especially in a technologically advanced place like New York, where many are ditching their physical wallet for digital wallets, being a cash-only establishment limits our customer base and costs us, and the State, much-needed revenue.

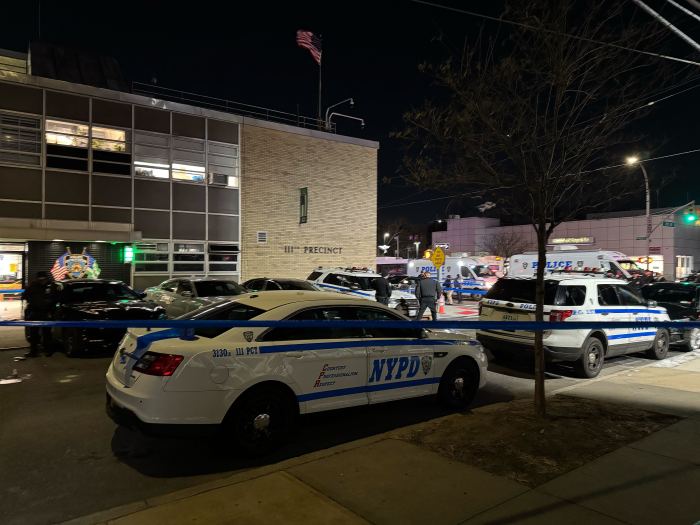

And prohibiting access to financial institutions is a small business issue and a public safety issue. Without proper access to a banking system, these businesses must operate as cash-only establishments. This poses a significant public safety risk to our customers and the hundreds of thousands of employees who work in the industry who are now susceptible to fraud, theft, and violent crime.

A simple solution would allow cannabis businesses in New York and nationwide to thrive and stay safe—the passage of the SAFE Banking Act. Senator Schumer has long argued that the goal of legalized cannabis programs is to benefit small businesses and local communities. Senator Schumer can now be the little guy’s champion and take the SAFE Banking Act to the Senate voting floor. It’s time to remove barriers for federally insured banks from working with legal cannabis companies. The current system is impeding the growth of small businesses while big corporations backed by private capital are gobbling up the market share. Pass the SAFE Banking Act and level the playing field for good.

Charlene S. Ali (Chef Ali) and Adam Ali are the owners of HiFive Edible Wonders.