Retailers are having a hard time finding their role on Broadway.

Manhattan Borough President Gale Brewer announced Monday that her office tallied 188 vacant storefronts on the iconic thoroughfare, thanks to volunteers who helped survey storefronts along the avenue’s entire span in Manhattan last month.

Brewer said a spate of shuttered storefronts can sap the vitality of a neighborhood, and called for using the data to delve into ways to combat vacancies.

“The normal ‘invisible hand’ of capitalism — old businesses closing and new ones quickly replacing them — too often doesn’t seem to work in Manhattan,” Brewer said in a statement. “Almost every neighborhood seems to have a storefront that’s been vacant for years. It can be a mystery, but I’m interested in solving the mystery and rejuvenating our streetscapes.”

Retail experts cited several factors hindering the industry: people purchasing items online rather than in brick-and-mortar shops, demographic shifts that have flooded areas with newcomers who eschew former mainstays, and a rental market in flux.

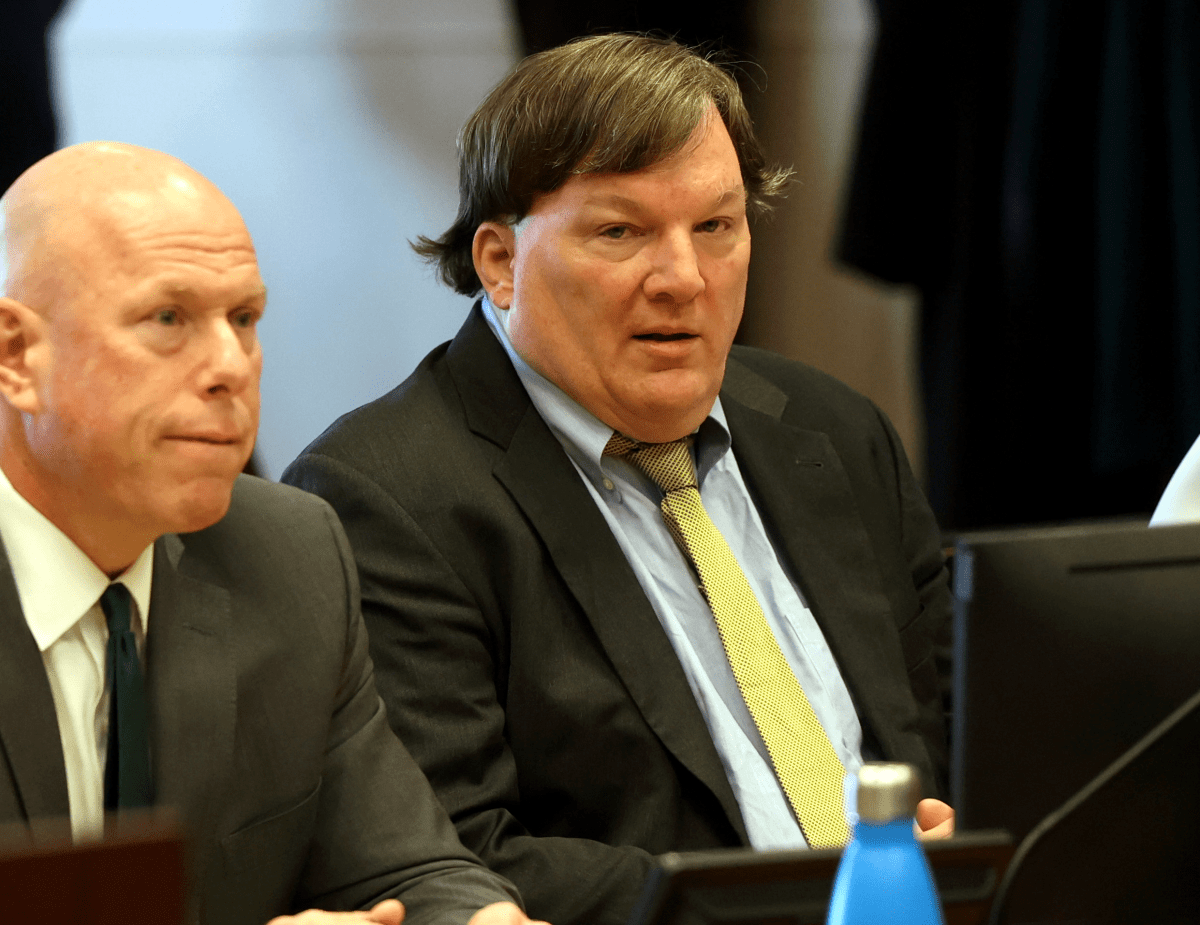

“You’re seeing the highest vacancy [rate] in Manhattan, at least, in history,” said Scott Plasky, a retail specialist in Marcus & Millichap’s Manhattan office. “They have opportunities to rent those spaces. There are tenants that want to be here: this is New York. But these guys either are unwilling or unable to lease at what the marketplace is telling them they’re worth.”

Plasky said some landlords are clinging to outdated expectations of how much rent they can collect because retail rents rose 90% in Manhattan between 2012 and 2014. They have since fallen nearly 21% as the retail industry continues to shut stores across the country, he said.

The vacancies on the strip range from the former homes of chains like Aeropostale in Times Square and American Apparel in SoHo to the Upper West Side staple Artie’s Deli.

Brewer’s office said they studied Broadway because it cuts through a cross-section of Manhattan neighborhoods.

Morningside Heights had the most vacancies, according to Brewer’s data. Merchants in the area claimed rent increases were the main culprit.

Nathan Franco, owner of Global Copy, said he recently talked his landlord into raising the store’s rent 10% and holding it there for a decade, rather than increasing it 3.5% annually over the course of a 10-year agreement. But he said many Morningside Heights business owners have not fared as well, pointing out storefronts left empty by a spice company and a UPS.

“Less stores means less people,” said Franco, 48, of Brooklyn, noting that empty storefronts concern him and other local merchants. “Business does well – we hope we’ll be able to do it.”

Michael Slattery, senior vice president of the Real Estate Board of New York, commended Brewer for mapping out empty storefronts, but said it is hard to assess trends across so many markets.

For instance, he said “stringent” regulations about retail stores may be behind the empty storefronts in SoHo — or possibly it’s as simple as the astronomically high rent rates.

Washington Heights, however, also has several unused retail spaces, which Slattery said was likely a reflection of income levels in the area.