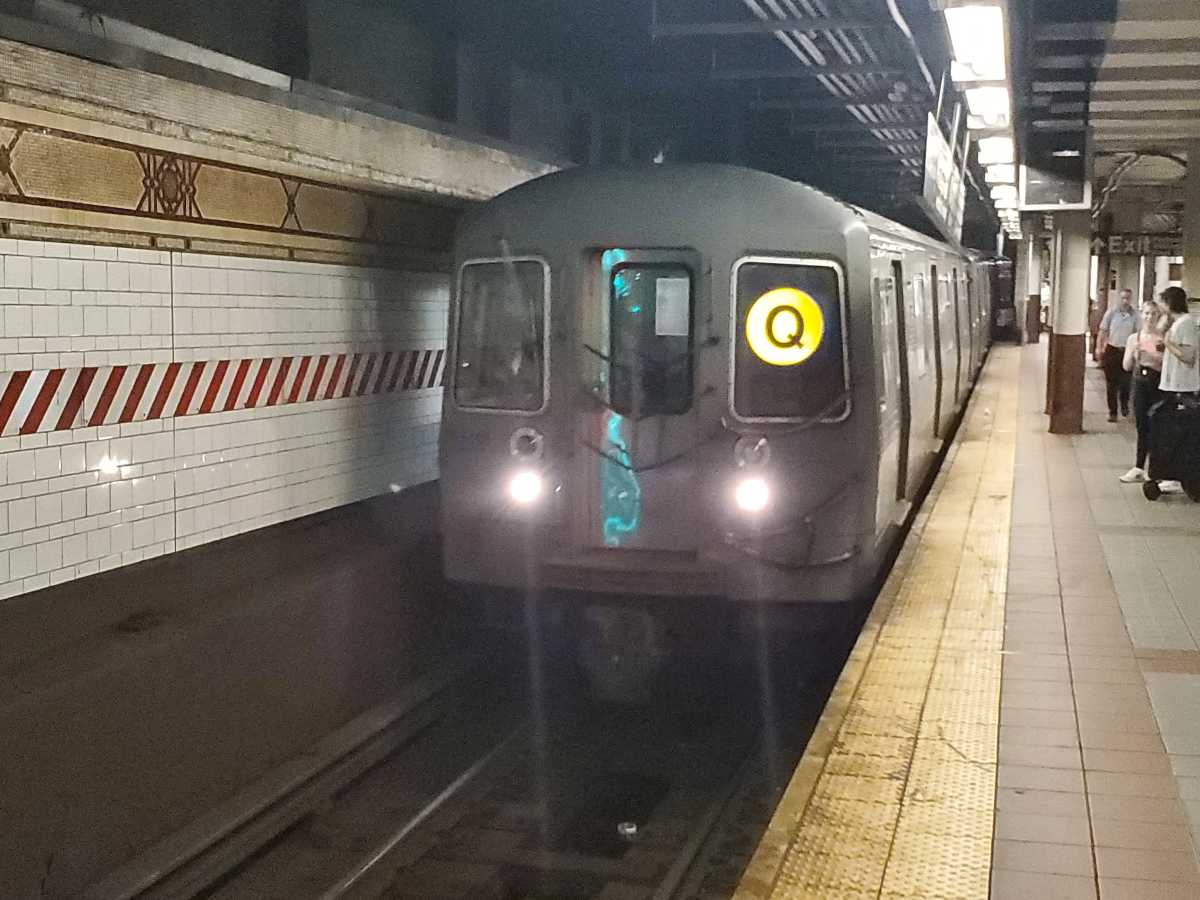

The MTA could face hundreds of millions of dollars in additional costs each year to run the transit system stemming from the pause on congestion pricing, putting significant pressure on the budget of an agency already struggling under huge levels of fare evasion.

After projecting years of balanced budgets in 2023 following a post-COVID financial rescue plan, the MTA is now projecting deficits of over $400 million per year starting in 2027 — largely from what the MTA acknowledges is up to $800 million in revenue losses each year from fare evasion, plus lower-than-expected revenue from real estate taxes funding the transit system.

So far in 2024, the MTA’s revenue from subway and bus fares is down 5.5% from what was projected in the 2024 operating budget, due to exceptionally high and growing levels of fare evasion post-pandemic.

But these numbers don’t even count the potential losses the authority faces from the pause on congestion pricing, which could amount to about $340 million in annual extra operating costs and $500 million in one-time costs this decade.

“From a financial planning perspective, the impact of the congestion pricing pause has not yet been incorporated into the budget beyond 2024, under the assumption either that the pause will be lifted or the replacement revenue will be provided,” said Kevin Willens, the MTA’s chief financial officer, at the agency’s monthly board meeting on Wednesday. “But as previously stated, the financial plan will be negatively impacted if that’s not the case.”

Red ink impacts operations

Should the pause not be reversed, the MTA forecasts it could have to spend up to $150 million extra per year on maintaining old buses rather than replacing them. It could also see about $90 million annually in additional repair work and emergency contracts to address defects in infrastructure that otherwise would have seen long-term fixes funded by the Manhattan toll.

The agency also projects about $70 million in annual costs from foregoing about 1.25% increased ridership that was predicted to be generated by congestion pricing, plus $10 million in costs due to buses not being sped up by a 17% decline in traffic in Manhattan’s central business district. The MTA would still bear these costs even if replacement revenue should materialize without the restoration of congestion pricing.

What’s more, the agency could face up to $500 million in one-time costs in the 2020s. That’s from having to issue, and pay back, bonds backed by fares earlier than previously expected, and from having to shift money for some 7,300 jobs supported by the multi-year capital plan — which funds long-term construction work and is now short $15 billion — into the annual operating budget, which funds regular payroll and running day-to-day service.

“Funding the capital program is critical to state of good repair, safe reliable service, so forth and so on. But it can’t be overly reliant on additional MTA debt,” said Willens. “So we need the capital program, but we need new dedicated revenues to pay for those investments, and not excessive amounts of new, MTA fare-backed debt that would again, really put a lot of pressure on fares, service levels, and the whole operating budget.”

For now, though, the MTA is not directly including the risks from the pause in its financial planning materials, insisting that the agency is “taking the governor at her word” that she will find a way to plug the $15 billion hole she blew in the MTA Capital Plan by pausing congestion pricing, which would have charged $15 to most motorists driving into Lower Manhattan.

An ‘unheard of’ setback

The projected funding hole is particularly extraordinary considering that just last year, the MTA was projecting five years of smooth sailing with balanced budgets — an “unheard of” situation, per MTA Board member Neal Zuckerman — following a post-COVID financial rescue plan for the agency’s operating finances, shepherded largely by Hochul herself.

The agency was facing at the time a “fiscal cliff” as its source of spending transferred back from federal COVID aid to its own finances, without a requisite recovery of its ridership as more New Yorkers work from home.

In a statement, Hochul spokesperson John Lindsay reiterated that the governor intends to shore up the MTA’s finances, though she still has not put forth a detailed plan on how to do it.

“After saving the MTA from the ‘fiscal cliff’ in last year’s budget, Governor Hochul remains committed to funding the MTA Capital Plan,” said Lindsay. “And she is working with partners in government on funding mechanisms while congestion pricing is paused.”

The effects of the congestion pricing pause — which is forcing the MTA to suspend billions of dollars in long-term construction investments — are just one of the MTA’s long-term financial challenges. Officials also forecast the agency will lose $800 million in revenue from farebeating annually for the next several years.

About 14% of subway riders are estimated to be evading the fare, and the MTA is spending money both on unarmed guards at turnstiles and pursuing new turnstiles of the future that are harder to jump, while also attempting delays in opening emergency exits that MTA boss Janno Lieber has called the “superhighway” of fare evasion.

City buses are a more acute challenge, with nearly half of bus riders estimated to be skipping the fare. The MTA deploys fare inspectors called “EAGLE Teams” on select and local buses, but has fewer obvious answers on how to prevent the ubiquitous practice of simply walking past the bus’s fare reader.

“This is a real tough one, because you can’t have a cop on every bus,” said Lieber. “And frankly, we don’t want to have a situation where every bus has to be policed.”

Read More: https://www.amny.com/nyc-transit/